Energy Saver North Carolina helps income-eligible homeowners and renters cover the cost of energy efficiency and electrification upgrades, such as heat pumps, electrical panels and insulation.

The Benefits:

- Saves energy and money on bills

- Improves homes, making them more comfortable, safe and resilient

- Reduces energy burden in communities statewide

- Support more than 2,300 jobs and boost local economies.

- Improved indoor and outdoor air quality

- Advance NC's 2050 goal of net-zero greenhouse gas emissions.

How it Works:

The program includes two pathways designed to help families make their homes more energy efficiency and affordable:

- Homeowners Managing Efficiency Savings (HOMES): Offers eligible households up to $16,000 for home efficiency upgrades, such as air sealing or energy-efficient HVAC units.

- Home Electrification and Appliance Rebates (HEAR): Provides up to $14,000 for high-efficiency electrical appliances like such as heat pump water heaters and electric stoves.

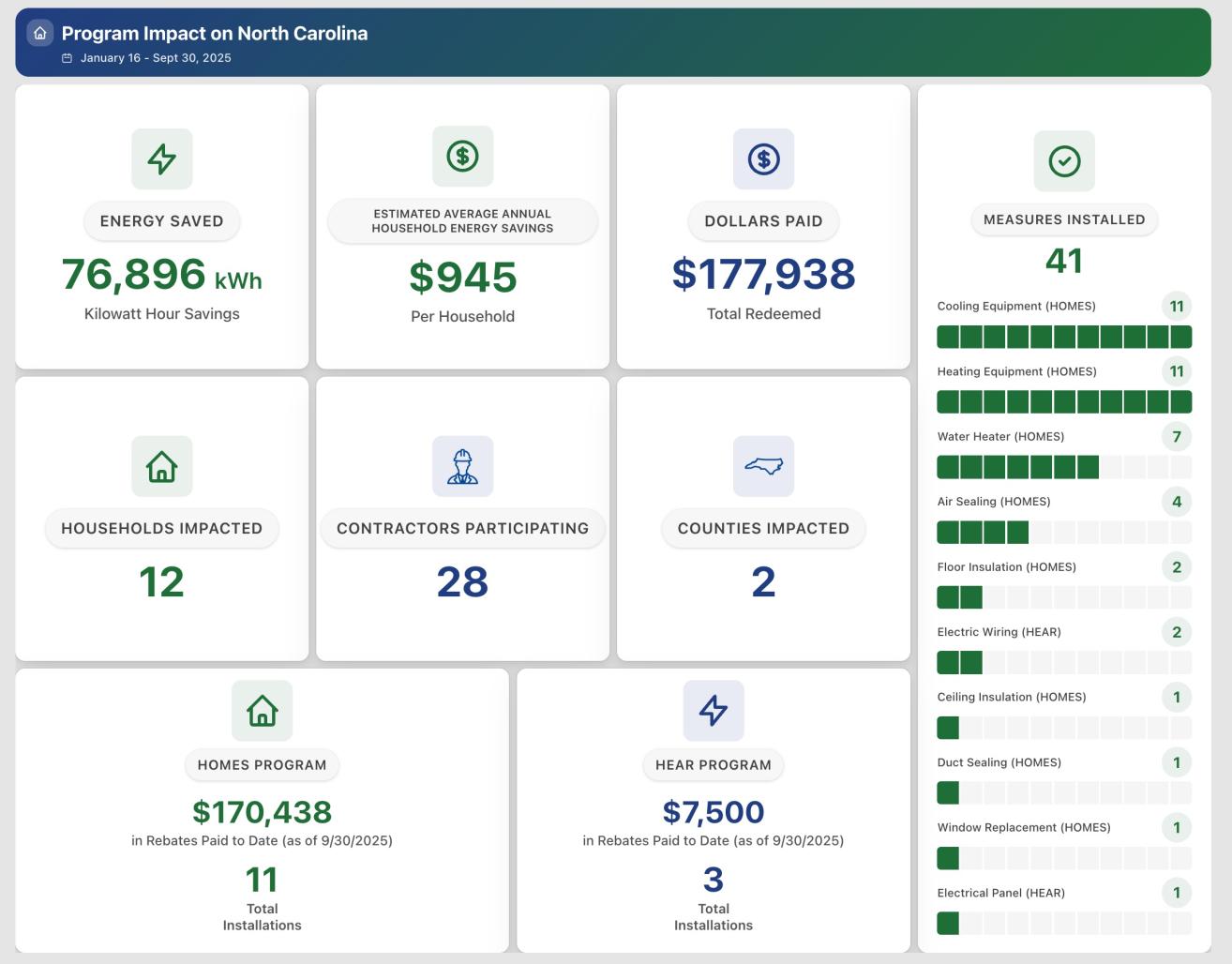

Our Impact

Which rebate is right for me?

These rebates are for improvements that increase the overall energy efficiency of a home, such as insulation, air sealing, and upgrading heating and cooling systems.

These rebates support the purchase of energy-efficient appliances and home electrification of home systems, like switching from gas to electric stoves or installing heat pump water heaters.

When will the program be available in my county?

Energy Saver North Carolina started in high energy burden communities. As program qualified contractors become available, including those in storm affected areas, the program will expand. Please refer to the Energy Saver NC County Expansion Phases Map.

| Phase | Counties |

|---|---|

| Phase 1 - Currently Active | Cleveland, Halifax |

| Phase 2 - May 2025 | Burke, Catawba, Lincoln, McDowell, Rutherford |

| Phase 3 - June 2025 | Avery, Buncombe, Caldwell, Henderson, Mitchell, Polk, Watauga, Yancey |

| Phase 4 - September 2025 | Alexander, Alleghany, Ashe, Cherokee, Clay, Gaston, Graham, Haywood, Jackson, Macon, Madison, Swain, Transylvania, Wilkes |

| Phase 5 - November 2025 | Bladen, Columbus, Cumberland, Duplin, Jones, Lenoir, Robeson, Sampson, Wayne |

| Phase 6 - December 2025 | Alamance, Anson, Beaufort, Bertie, Brunswick, Cabarrus, Camden, Carteret, Caswell, Chatham, Chowan, Craven, Currituck, Dare, Davidson, Davie, Durham, Edgecombe, Forsyth, Franklin, Gates, Granville, Greene, Guilford, Harnett, Hertford, Hoke, Hyde, Iredell, Johnston, Lee, Martin, Montgomery, Moore, Nash, New Hanover, Northampton, Onslow, Orange, Pamlico, Pasquotank, Pender, Perquimans, Person, Pitt, Randolph, Richmond, Rockingham, Rowan, Scotland, Stanly, Stokes, Surry, Tyrrell, Union, Vance, Warren, Washington, Wilson, Yadkin |

| Phase 7 - January 2026 | Mecklenburg, Wake |

Program Timeline

DEQ designed the Energy Saver NC timeline to meet all the important rules and standards from DOE. Additional milestones include:

- DEQ submits applications on June 28, 2024.

- DEQ submits additional required program design plans, also known as Blueprints, on August 28, 2024.

- DOE approved the applications on September 29, 2024

- DOE approved the Blueprints on January 14, 2025.

- DEQ launched the Energy Saver NC on January 16, 2025.

DEQ expects the program to run until 2031 or until funds are depleted.

U.S. Department of Energy Eligibility Guidelines

Participant Eligibility

Who is eligible to participate?

- Single-family homeowners

- Multifamily building owners

- Tenants (with permission from owner)

Which homeowner types are prioritized?

- Low-Income Residents: those with household income levels below 80% of Area Median Income

- Moderate-Income Residents: those with household income levels between 80% and 150% of Area Median Income

- There must be at least 20% energy savings for major home upgrades (this applies to to HOMES rebates only)

- Appliances must be ENERGY STAR certified

- There must be a total rebate cap by home/homeowner

- Contractors are required to perform installation

Some guidelines have been set by DOE for all states, but NC's program may include additional or more specific eligibility requirements.

Rebate Levels by Project

Recommended Rebates for Example Projects:

| Rebate Amount (up to) | Project Type |

|---|---|

| $8,000 | Heat pump for space heating/cooling |

| $1,750 | Heat pump water heater |

| $4,000 | Electric load service center |

| $2,000 | Electric wiring |

| $1,600 | Insulation, air sealing, ventilation |

| $840 | Electric stove |

| $840 | Heat pump clothes dryer |

Total rebate cannot exceed actual project costs

Q. What is the Inflation Reduction Act?

A. President Joseph R. Biden signed the landmark Inflation Reduction Act (IRA) into law on Aug. 16, 2022. The law authorizes $391 billion in spending on energy and climate change, including roughly $35 billion clean energy investments managed through DOE. The IRA represents the single largest investment in tackling the climate crisis and investing in clean energy in U.S. history.

Q. What are the home energy rebates?

A. The Energy Saver North Carolina rebates provide discounts on household upgrades to lower utility bills. These include ENERGY STAR® appliances, insulation, and more. These rebates are made available through Homeowner Managing Efficiency Savings (HOMES) and Home Electrification and Appliance Rebate (HEAR).

Q. Who is eligible for these rebates?

A. Eligibility is based on annual income and household size. North Carolina residents, both owners and renters of single or multi-family homes, may qualify. Enrollment in federal assistance programs like LIEAP or Medicaid can also make you eligible for greater rebates without additional income verification.

| Benefit Type | Income Threshold |

|---|---|

| Up to 100% of project costs covered by the rebate up to a certain amount | Household income less than 80% of AMI |

| Up to 50% of project costs covered by the rebate up to a certain amount | Household income between 80% and 150% of AMI |

| Not Eligible | Income more than 150% of AMI |

Renters need landlord approval. Multifamily building owners can receive a greater rebate level if over 50% of tenants meet the income eligibility requirements.

Q: Will the Energy Saver North Carolina program integrate with existing home energy benefit programs, e.g., LIEAP or WAP?

A. Yes. Participants in programs like Low-Income Energy Assistance Program (LIEAP) or the Weatherization Assistance Program (WAP) can participate in the Energy Saver North Carolina program if they meet eligibility criteria. Those on the WAP waitlist can also apply. However, double counting rebates from different federal grants for the same upgrade is not allowed.

Q. What can I get a rebate for, and how much can I save?

A. Energy Saver North Carolina rebates are available through Homeowner Managing Efficiency Savings (HOMES) and the Home Electrification and Appliance Rebate (HEAR). HEAR offers various upgrades, including:

- Up to $8,000 for an ENERGY STAR-certified electric heat pump.

- Up to $4,000 for an electrical panel.

- Up to $2,500 for electrical wiring.

- Up to $1,750 for an ENERGY STAR-certified electric heat pump water heater.

- Up to $1,600 for ENERGY STAR-certified insulation, mechanical ventilation products and air sealing

- Up to $840 for an ENERGY STAR-certified heat pump dryer or combo washer/dryer.

- Up to $840 for an ENERGY STAR certified electric range or cooktop.

Each Energy Saver North Carolina rebate has certain eligibility requirements for the existing materials/appliances you replace and the materials/appliances you replace them with. See the application or program overview for details.

Q. How do I figure out which upgrades make sense for my home?

A. Once you’re eligible, your next steps depend on the program you choose. For rebates through Home Electrification and Appliance Rebate (HEAR), use the registered contractor finder, filter for the products you want to install, and get quotes. For rebates through Homeowner Managing Efficiency Savings (HOMES), schedule a free home assessment. This will show you potential projects and upgrades that qualify for rebates and federal tax credits. Each Energy Saver North Carolina program rebate has specific requirements for the old materials/appliances you replace and the new ones you install.

Q. What are the rebate limits?

A. The maximum rebate per dwelling is either $14,000 for the Home Electrification and Appliance Rebate (HEAR) or $16,000 for Homeowner Managing Efficiency Savings (HOMES) for whole home energy upgrades, depending on your income and qualified needs. If you think you may be eligible, we can help you find out what you qualify for.

Q. Can households receive home energy rebates for a product as well as utility incentives?

A. Yes, households can receive both home energy rebates and utility incentives for the same product, however, the combined rebates cannot exceed the purchase-price of the product.

Q. Can self-installation projects qualify for home efficiency rebates?

A. No, self-installation projects do not qualify for Energy Saver North Carolina rebates. All installations must be completed by a registered contractor to be eligible for the rebates.

Q. Is the Energy Saver North Carolina program for emergency assistance (e.g., difficulty paying utility bills, hurricane damage)?

A. No, the Energy Saver North Carolina program is for proactive home energy upgrades, not emergencies. For emergency assistance, contact the North Carolina Department of Health and Human Services (DHHS) and North Carolina Department of Public Safety (DPS). If you are replacing broken equipment in a hurry, we recommend the HEAR program rebates which do not require scheduling a full home energy assessment.

Q: What if I want to conduct an energy efficiency or electrification project in my home but am not eligible for this program?

A. If you’re not eligible, other resources may be available. Your utility provider might offer rebates for specific projects or appliances. Contact them for more info. The IRS also offers the Energy Efficient Home Improvement Tax Credit.

Q. How do I mail my paper eligibility application?

A. We’re accepting paper applications and will start processing them on March 1, 2025. To submit a paper eligibility application, just follow these steps: fill out the application, put it in an envelope, address it to Energy Saver North Carolina, 1613 Mail Service Center, Raleigh NC 27699-1613, add a stamp, and mail it.

Q. I’ve already installed my energy efficiency equipment. Can I still apply for a rebate?

A. HEAR retroactive rebates aren’t available. HOMES retroactive rebates are for projects that:

- Meet all DOE requirements in the requirements document. NC is using the modeled approach.

- Started on or after August 16, 2022

- Meet any additional state requirements.

For more details, check out the Home Efficiency Rebates Retroactivity Fact Sheet

Q: Will the program prioritize areas impacted by Hurricane Helene?

A: We recognize the great need in the areas impacted by Hurricane Helene. The HOMES and HEAR rebate program relies on certified contractors to perform the necessary work, so we are focusing our initial efforts on contractor recruitment and training. As we train and certify contractors, we will expand our efforts to include western North Carolina. Assistance resources for residents, businesses and communities impacted by Hurricane Helene can be found on DEQ’s website under Hurricane Recovery Information and Assistance Resources. Residents can also find local services through our Weatherization Assistance Program Subgrantees.

Q: When will the program be available in my County?

A: Energy Saver North Carolina started in high energy burden, disadvantaged communities. As program qualified contractors become available, including those in storm affected areas, the program will expand. Please refer to the Energy Saver NC County Expansion Phases Map.

Q: Will there be funds available when the program expands to my county?

A: Yes. Funding levels are proportional to the number of eligible households within each region. However, once Energy Saver NC becomes available in a region, the program operates on a first come first serve basis. It is expected to run until 2031 or until all program funds are depleted, whichever comes first.

Q: Should I still apply now even though the program has not expanded to my county yet?

A: The Energy Saver NC program operates on a first come first serve basis. To check your eligibility, we encourage you to start your online application and gather your income documentation as supporting material. This will help us process your application faster when we have qualified contractors in your area.